long island tax rate

New Yorks maximum marginal income tax rate is the 1st highest in the United States ranking directly. To learn more call 631-761-6755.

/CIA_map_of_the_Caribbean-822e94431d4647ba9ca350ebf28eb23b.png)

Top 10 Offshore Tax Havens In The Caribbean

4 rows Currently the sales tax rate in Long Island City is 8875 percent.

. Total SALT deductions In thousands 126583. Assessment Challenge Forms Instructions. The 7 sales tax rate in Long Island consists of 65 Kansas state sales tax and 05.

ZIP code 11003. Returns with SALT deductions 7200. The new top rate would apply only to people earning over 1 million per year.

The New York state sales tax rate is currently. Also Nassau Suffolk counties. Long Island Tax Accounting Advisory Services Inc.

The County sales tax rate is. The Long Island City sales tax rate is. Nassau County Tax Lien Sale.

Biden tax plan and real estate. Average real estate tax 1062715. The 8875 sales tax rate in Long Island City consists of 4 New York state sales tax.

Video Player is loading. Has impacted many state nexus laws and sales tax collection requirements. The New York sales tax rate is currently.

The Nassau County sales tax rate is. For tax preparation accounting services in Suffolk County visit Weisman CPA the most trusted Long Island CPA firm. Method to calculate Long Island sales tax in 2021.

Its that time of the year again - today is. Today marks final day to file federal income taxes. In case you are determined to still live in this part of New York you should find.

The minimum combined 2022 sales tax rate for Long Island City New York is. New York collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Queens and Brooklyn have better options but towns further into Long Island in Nassau and Suffolk County have head-spinning property tax costs.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. This is the total of state county and city sales tax rates. I would refer to Newsday major metro NYC newspaper founded on Long Island for their average Nassau County tax rate chart for 2016.

Since these can be a little confusing it is also useful to look at effective tax rates. A mill is equal to 1 of tax for every 1000 in property value. Answer 1 of 2.

The 2018 United States Supreme Court decision in South Dakota v. Like the Federal Income Tax New Yorks income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. These are actual tax amounts paid as a percentage of home value.

Real estate tax rates in New York are given in mills or millage rates. Keep this information in mind while determining which county of Long Island will serve your needs the best. Long Island County Tax Rate Median Annual Property Tax Payment.

Long Island school districts 2016-17 tax plans I grew up in. But under Bidens tax plan individual long-term gains would increase from a 20 rate to a maximum rate of 396 on ordinary income. Finally a firm that gives you the individual attention that you deserve.

Our clients can always contact us at our Roslyn Long Island office for. 10 rows Tax Rates. High Taxes in Long Island New York reduce property taxes.

Among the many different counties of New York Suffolk and Nassau counties on Long Island have some of the highest property tax rates both over 2. The minimum combined 2022 sales tax rate for Nassau County New York is. This is the total of state and county sales tax rates.

You would pay capital gains on that 300000 increase in property value at a 20 tax rate. Average SALT deductions 1758097. Note that this also includes the price needed for school property taxes.

The current total local sales tax rate in Long Island. Lower Property Taxes In Suffolk and Nassau New York Call Heller Tax Grievance for a Free tax grievance application. How to Challenge Your Assessment.

This is a modal window. In Alaska the sales tax rate is 0 the sales tax rates in cities may differ from 0 to 7. The December 2020 total local sales tax rate was also 7000.

The Sales tax rates may differ depending on the type of purchase. Rules of Procedure PDF Information for Property Owners. 4 rows Long Island City NY Sales Tax Rate.

The median property tax bill in Suffolk County tends to be right around 9500. Long Island KS Sales Tax Rate The current total local sales tax rate in Long Island KS is 7000.

State Corporate Income Tax Rates And Brackets Tax Foundation

/shutterstock_98009558-5bfc477846e0fb0051823da0.jpg)

Tax Havens All You Need To Know

New York Property Tax Calculator Smartasset

What S Your Tax Rate For Crypto Capital Gains

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Countries With The Highest Income Tax Rates You Should Know About

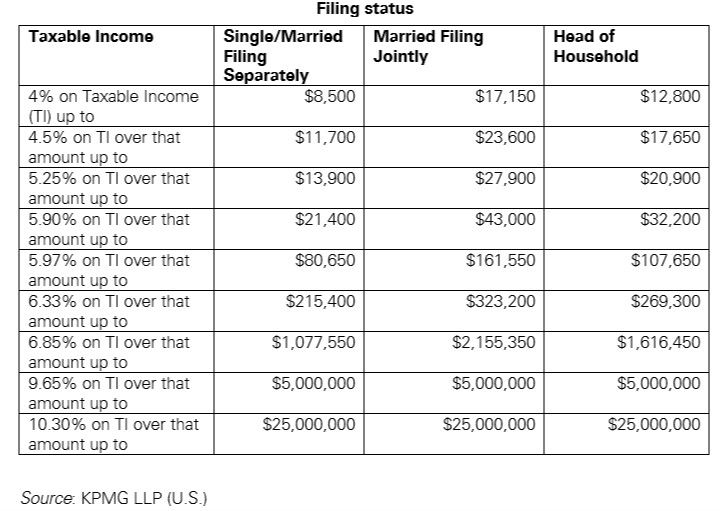

Us New York Implements New Tax Rates Kpmg Global

What To Know Before Moving To Long Island

County Surcharge On General Excise And Use Tax Department Of Taxation

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

New Jersey Nj Tax Rate H R Block

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

The Minimum Income Necessary To Afford A Five Million Dollar House

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times